Video

Nathan Direct: 403-588-0800

Nathan Direct: 403-588-0800

Calgary, Alberta, Jan. 2, 2026– Following several years of strong price growth, 2025 marked a year of transition thanks to strong demand and limited supply. Due to record high starts, supply levels improved across all aspects of the housing market, just as demand pressure eased due to a reduction in migration levels and heightened uncertainty that persisted throughout the spring market. This helped shift the resale market from one that favoured the seller to one that was more balanced.

In 2025, sales reached 22,751 units, down 16 per cent over last year, but in-line with long-term trends. Much of the shift came from the growth in supply. 2025 saw over 40,000 new listings come onto the market, nine per cent higher than last year, causing inventories to rise and driving more balanced conditions.

“Supply levels were expected to rise in 2025. However, the growth was higher than expected especially for apartment condominium and row homes. This weighed on prices in those sectors enough to offset the annual gains reported for both detached and semi-detached homes,” said Ann-Marie Lurie, CREB®’s Chief Economist. "Adjustments in both supply and demand varied across the city, with pockets of the market continuing to experience seller’s market conditions versus some areas where the conditions favoured the buyer. This resulted in different price trends based on location, price range and property type.”

Overall, the annual average total residential benchmark price in 2025 was $577,492, two per cent lower than last year’s annual average. However, annual detached and semi-detached prices rose by a respective one and three per cent, while apartment and row homes saw prices fall by a respective three and two per cent.

Compared to other districts, the North East reported the largest decline in prices this year. While some of this is related to improved supply across all areas of the city, it is also important to note that the North East district also reported the strongest price growth over the past two years.

For the first time in three years, we are heading into the New Year with better inventory levels. Details on what is expected to happen in the market in 2026 will be released at CREB®’s annual Forecast Conference on Jan. 20, 2026.

Detached

Detached sales totaled 11,328 in 2025, down by nearly nine per cent compared to last year. Sales eased across all districts in the city, with the steepest declines occurring in the North East, East and City Centre district. However, unlike the City Centre, the North East and East districts also experienced significant gains in inventory compared to long-term trends, driving annual price declines of two per cent. Meanwhile, in the City Centre detached inventory remained well below long-term averages, which likely prevented stronger sales and contributed to the annual price growth of over three per cent. Despite the differing conditions in different areas of the city, slowing sales and rising supply citywide helped move the market into balanced conditions by the second half of the year. The annual average benchmark price was $752,767, one per cent higher than last year’s annual level.

Semi-Detached

Semi-detached homes represent the smallest segment of the market, accounting for less than 10 per cent of all sales activity. Sales in 2025 were 2,159, eight per cent lower than last year, but slightly higher than long-term trends. Trends for semi-detached homes have been relatively consistent with the detached market. However, it took longer for this segment of the market to shift to more balanced conditions, resulting in stronger annual price gains. In 2025, the average annual benchmark price was $685,850, nearly three per cent higher than last year. Prices did ease in the North district as competition for new homes weighed on resale activity, but the decline in this district was more than offset by the four per cent gain in the City Centre.

Row

2025 sales eased by 17 per cent to 3,838 units. Despite the decline, sales were still higher than long-term trends, as row homes are starting to account for a larger share of the overall activity in the city. At the same time, new listings also rose relative to sales, driving inventory gains and taking the pressure off prices. Conditions shifted to more balanced levels relatively early in the year, and by the last quarter conditions ranged from a balanced to a buyer’s market depending on the districts of the city. Overall, this contributed to the annual average benchmark price decline of two per cent. While prices were relatively stable in the City Centre, North West, West and East districts, additional supply in the resale market and competition from new homes caused prices to decline by four per cent in the North East and North districts.

Apartment Condominium

Apartment-style homes reported the largest adjustment in price in 2025. Sales declined by 28 per cent compared to the near record high levels achieved last year. While the decline was significant, sales were still over 28 per cent higher than long-term trends. The main cause of the shift in conditions was due to the supply. Over the past three years, there has been a rise in apartment-style starts. While most of the apartment starts were purpose-built rental, they are adding to the supply choice and weighing on the resale market. Resale condominiums saw the market shift in favour of buyers by the second half of the year, with elevated months of supply being reported in most districts of the city. This resulted in relatively persistent downward pressure on prices, causing the annual average benchmark price to decline by nearly three per cent. Price declines were the steepest in the North East nearing five per cent. The only area to report relative stability in the annual price was in the West district.

Airdrie

Increased competition from the new home market, along with more supply options in competing resale markets, has contributed to the added supply in the resale market in Airdrie. Following four consecutive years of exceptionally low inventory levels, 2025 saw inventory rise to levels not seen since prior to the pandemic. While sales activity did remain in line with long-term trends despite an annual decline, the push up in inventories caused the months of supply to generally rise throughout the year. Overall, the annual average benchmark price eased by two per cent this year.

Cochrane

Sales in Cochrane were similar to last year and above long-term trends. While demand stayed relatively strong in the town, steady gains in supply did cause conditions to shift to a more balanced state by the end of 2025. With the shift occurring later in the year, we did not see the same downward pressure on prices. In fact, on an annual basis the benchmark price in Cochrane was $578,325, nearly three per cent higher than last year. Cochrane also tends to see a larger share of newer properties being listed and sold on the resale market, impacting the prices in the resale market.

Okotoks

Okotoks continued to struggle with supply growth. Inventories did rise by over 40 per cent, but levels were exceptionally low last year. Even with the gain in 2025, levels were still 30 per cent below long-term trends. Sales activity in the town remained consistent with the levels reported last year and were higher than long-term trends. The persistently low inventory levels generally kept market conditions relatively tight. However, total residential prices posted only a modest gain over last year, this is likely due to compositional shifts as price growth ranged from over one per cent for detached homes to nearly eight per cent for apartment condominium product.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Row

2025 sales eased by 17 per cent to 3,838 units. Despite the decline, sales were still higher than long-term trends, as row homes are starting to account for a larger share of the overall activity in the city. At the same time, new listings also rose relative to sales, driving inventory gains and taking the pressure off prices. Conditions shifted to more balanced levels relatively early in the year, and by the last quarter conditions ranged from a balanced to a buyer’s market depending on the districts of the city. Overall, this contributed to the annual average benchmark price decline of two per cent. While prices were relatively stable in the City Centre, North West, West and East districts, additional supply in the resale market and competition from new homes caused prices to decline by four per cent in the North East and North districts.

Apartment Condominium

Apartment-style homes reported the largest adjustment in price in 2025. Sales declined by 28 per cent compared to the near record high levels achieved last year. While the decline was significant, sales were still over 28 per cent higher than long-term trends. The main cause of the shift in conditions was due to the supply. Over the past three years, there has been a rise in apartment-style starts. While most of the apartment starts were purpose-built rental, they are adding to the supply choice and weighing on the resale market. Resale condominiums saw the market shift in favour of buyers by the second half of the year, with elevated months of supply being reported in most districts of the city. This resulted in relatively persistent downward pressure on prices, causing the annual average benchmark price to decline by nearly three per cent. Price declines were the steepest in the North East nearing five per cent. The only area to report relative stability in the annual price was in the West district.

Increased competition from the new home market, along with more supply options in competing resale markets, has contributed to the added supply in the resale market in Airdrie. Following four consecutive years of exceptionally low inventory levels, 2025 saw inventory rise to levels not seen since prior to the pandemic. While sales activity did remain in line with long-term trends despite an annual decline, the push up in inventories caused the months of supply to generally rise throughout the year. Overall, the annual average benchmark price eased by two per cent this year.

Sales in Cochrane were similar to last year and above long-term trends. While demand stayed relatively strong in the town, steady gains in supply did cause conditions to shift to a more balanced state by the end of 2025. With the shift occurring later in the year, we did not see the same downward pressure on prices. In fact, on an annual basis the benchmark price in Cochrane was $578,325, nearly three per cent higher than last year. Cochrane also tends to see a larger share of newer properties being listed and sold on the resale market, impacting the prices in the resale market.

Okotoks continued to struggle with supply growth. Inventories did rise by over 40 per cent, but levels were exceptionally low last year. Even with the gain in 2025, levels were still 30 per cent below long-term trends. Sales activity in the town remained consistent with the levels reported last year and were higher than long-term trends. The persistently low inventory levels generally kept market conditions relatively tight. However, total residential prices posted only a modest gain over last year, this is likely due to compositional shifts as price growth ranged from over one per cent for detached homes to nearly eight per cent for apartment condominium product.

Acadia | Belmont | Bonavista Downs

Braeside | Bridlewood | Canyon Meadows

Cedarbrae | Chaparral | Chinook Park

Deer Ridge | Deer Run | Diamond Cove

Eagle Ridge | Evergreen | Fairview

Haysboro | Kelvin Grove | Kingsland

Lake Bonavista | Legacy | Maple Ridge

Midnapore | Millrise | Oakridge | Palliser

Parkland | Pump Hill | Queensland

Shawnee Slopes | Shawnessy | Silverado

Somerset | South Calgary | Southwood

Luxury homes are high-end residential properties that offer superior quality, design, and amenities. These homes typically feature spacious layouts, premium building materials, state-of-the-art technology, and a high level of craftsmanship. Luxury homes are often located in prestigious areas, offering breathtaking views, privacy, and exclusivity. Key characteristics might include features like large swimming pools, home theatres, smart home systems, expansive gardens, and top-of-the-line appliances. In addition to the physical attributes, luxury homes also tend to be priced significantly higher than average homes due to their exceptional quality and unique locations.

#luxuryhomes #luxuryrealtor #acreages #acreagerealtor

# Luxuryinstitutemember # Calgaryluxuryhomes

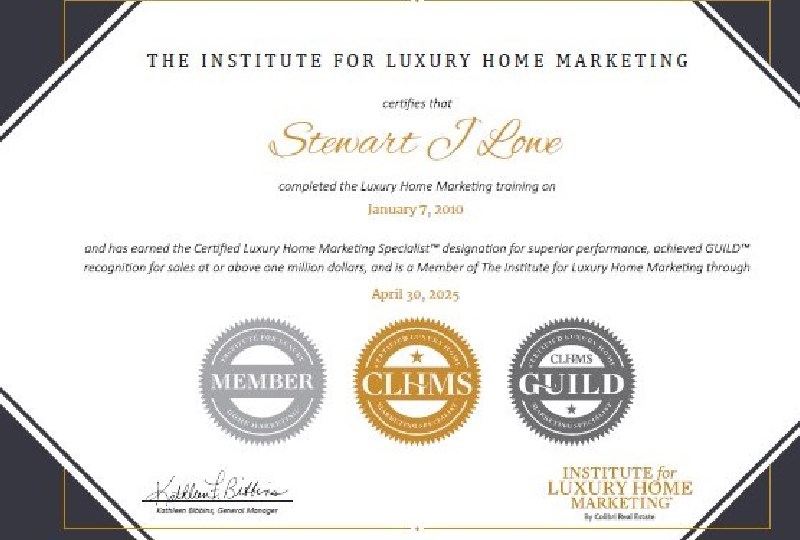

Members of The Institute for Luxury Home Marketing who hold the CLHMS designation (Stewart J Lowe-Calgary & Area) have successfully documented performance in the TOP 10% of their markets, and have successfully demonstrated their expertise in the luxury home and estate market.

Achieving Guild Recognition

***As a Guild Member of The Institute for Luxury Home Marketing™ Team Leader Stewart J Lowe is part of an International Network of Real Estate Professionals who specialise in the Luxury Market. Reach out for us to represent you!

THE VALUE OF HAVING AN INSTITUTE MEMBER ON YOUR SIDE

#luxuryhomes # calgaryluxuryhomes #luxuryrealtor #luxurymarketingspecialist # luxuryacreages #calgarydreamhomes

Big City living in Calgary isn’t for everyone, some people like to look up at stars instead of the city lights. So moving out of a City or suburbs to a rural area might be next on your bucket list. If it is, here are a quick glance at what you need to look at, but we always advise to talk to a lender who understands rural sales, we can suggest a few.

CONDO LIVING IN CALGARY is for the buyer who just wants to be in the centre of everything. There are many common misconceptions about owning a condo such as big condo fees and rules that determine what you can or can't-do.

#condoliving #calgarycondos #condospecialist #luxurymarketingcondos